Introduction

Sarah thought she'd done everything right. She researched credentials, checked reviews, and even asked her friends for referrals. But six months after hiring her financial advisor, she was frustrated and confused about her own money. Her advisor rarely returned calls, pushed expensive products she didn't understand, and seemed to treat her like just another account number.

Sound familiar?

Here's the uncomfortable truth: most people spend more time researching their next car purchase than they do vetting their financial advisor. And that's exactly why so many end up in relationships that don't actually help them build wealth.

Look, we get it. The whole process feels overwhelming. There are thousands of advisors out there, they all sound similar in their marketing, and frankly, most of the "how to choose an advisor" content online is either written by advisors themselves (conflict of interest much?) or focuses on surface-level stuff like credentials.

But here's what actually matters: asking the right questions before you hire someone. Not the softball questions most people ask, but the ones that reveal whether this person can actually help you – and whether they'll stick around to do it.

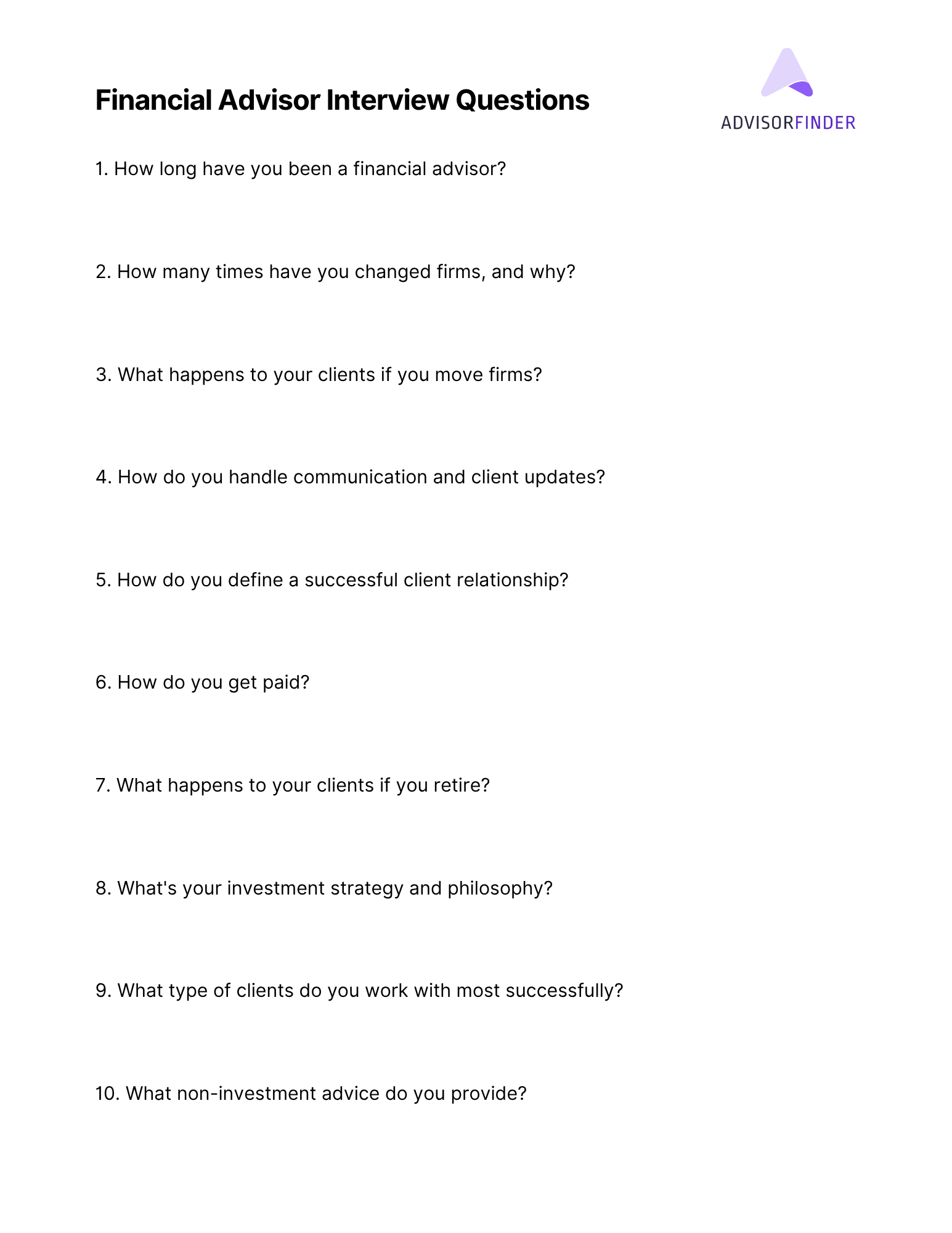

This article covers 10 essential questions to ask potential financial advisors to ensure you find someone who matches your communication style, investment philosophy, and long-term financial goals. We also included a .PDF list of these 10 questions so you can download it, print it out, and take it with you to your advisor interviews.

Download the list of questions here ⬇️

"How long have you been a financial advisor?"

This isn't small talk – it's intel gathering.

Experience matters way more than most people realize, especially when markets get weird (and they always get weird eventually). An advisor who's been through 2008, the dot-com crash, or even just a few normal market corrections has seen things that textbooks can't teach.

But here's the follow-up that matters: if they're new, ask why they became an advisor and what they did before. The best answer? Someone who switched careers because they were genuinely passionate about financial planning, not because they got laid off and needed a job.

Red flag answer: "I've been doing this for 20 years" but they can't give you specific examples of how they helped clients through tough times.

Good answer: They can tell you exactly how they guided clients through specific market events, even if they've only been doing this for 3-4 years.

Related Follow-up Questions:

- What motivated you to become a financial advisor?

- What did you do before becoming an advisor?

"How many times have you changed firms, and why?"

This question might make some advisors uncomfortable. Good, that's the point.

Here's what you're really asking: Are you building a long-term practice, or are you just chasing signing bonuses every few years? Ok that might be a little harsh, and obviously some advisors may be changing firms for good reasons. If the advisor you're interviewing has changed firms, it's worth asking why and deeply understanding their reason(s).

When advisors switch firms, they may receive some kind of upfront payout – it can be six figures, depending on the size of their book of business. That's not inherently bad, but you want to know if their career moves are about serving clients better or something else.

Red flag answer: Vague responses like "better opportunities" or "cultural fit" without specifics, especially if they've moved multiple times recently.

Good answer: Clear, client-focused reasons like "My previous firm limited the investment options I could offer" or "I wanted to be independent so I could provide more objective advice" or "My previous firm didn't offer the technology that my clients wanted" as a few examples.

"What happens to your clients if you move firms?"

No one asks this question. That's exactly why you should.

When advisors switch firms, they legally can't contact their clients until after the move. Meaning you could wake up one day to find your advisor gone and some stranger managing your money at the old firm.

A good advisor has thought about this and has a plan in place, well in advance of switching firms. A mediocre one will give you a deer-in-headlights look.

Red flag answer: "Oh, that won't happen" or "I hadn't really thought about that."

Good answer: A clear explanation of their succession plan and how they'd handle client transitions, including specific timelines and communication strategies.

"How do you handle communication and client updates?"

This is where you find out if you're getting a partner or a ghost.

Some advisors talk to clients weekly. Others go dark for months at a time. Neither is necessarily wrong, but you need to know what you're signing up for.

More importantly: ask how they communicate during market volatility. When your portfolio drops 20% in a month, are they proactively calling to explain what's happening, or are you left wondering if they're even paying attention?

Red flag answer: "I'll call you when there's something important" without defining what "important" means.

Good answer: Specific communication schedules and clear examples of when they reach out proactively (market changes, life events, planning opportunities).

"How do you define a successful client relationship?"

This question reveals everything about how they see their job.

Some advisors think success means beating the S&P 500. Others focus on helping you sleep well at night. Others want to be your financial therapist for every money decision.

None of these approaches is wrong, but you need to know which one you're getting.

Red flag answer: Only talking about investment returns or being unable to articulate what success looks like.

Good answer: A holistic view that includes your peace of mind, financial goals, and life circumstances – not just portfolio performance.

Ultimately, you have to be comfortable with their answer and make sure it aligns with your definition of a successful client-advisor relationship.

"How do you get paid?"

Yeah, it's awkward. Ask anyway.

Here's why this matters way more than the actual fee amount: compensation structure creates incentives. And incentives drive behavior. You need to know what's driving your advisor's recommendations.

Fee-Only Advisors

They charge you directly through one of these methods:

- Assets Under Management (AUM): Usually 0.5% to 1.5% of your portfolio annually. So if you have $500,000 invested, you'd pay $2,500 to $7,500 per year.

- Hourly rates: Typically $200-$500 per hour for specific advice or financial planning.

- Flat project fees: Maybe $2,000-$5,000 for a comprehensive financial plan.

- Retainer fees: Monthly or quarterly payments, often $200-$500 per month.

The good: No conflicts of interest from product sales. Their only incentive is to help you grow your wealth (which grows their fee too).

The catch: Can be expensive if you don't have much money to invest yet.

Commission-Based Advisors

They get paid when you buy specific products:

- Mutual fund loads: Often 3-5% upfront (so $3,000-$5,000 on a $100,000 investment)

- Insurance commissions: Can be 50-100% of your first year's premium

- Annuity commissions: Often 4-7% of what you invest

- Transaction fees: Maybe $50-$100 per trade

The good: No upfront cost to you for advice.

The catch: They make more money selling you expensive products, whether you need them or not.

Fee-Based Advisors (Hybrid)

They charge fees AND earn commissions. This is where it gets murky because their incentives are mixed.

The question you actually need to ask: "Show me exactly how much I'll pay in the first year, and how that breaks down."

Make them give you real numbers based on your situation. If you're investing $200,000, don't accept vague percentages – ask for the dollar amount.

👉 here is a detailed breakdown of financial advisor fees

Red flag answers:

- "It depends" without giving you specifics

- Making it sound more complicated than it needs to be

- Focusing only on their "low" percentage without mentioning other fees

- Getting defensive when you ask for details

Good answers:

- Clear breakdown of all costs in dollar amounts

- Honest discussion of any potential conflicts of interest

- Willingness to put fee structure in writing

- Examples of how fees would change as your account grows

Pro tip: Ask to see their Form ADV Part 2A. It's a document they're required to provide that explains exactly how they get paid. If they hesitate or don't have it readily available, that's a red flag.

"What happens to your clients if you retire?"

Plot twist: the average financial advisor is 56 years old.

If you're building a 20-30 year relationship with someone, there's a decent chance they'll retire before you do. You need to know what happens to your money when that happens.

Good advisors have succession plans. Great advisors will introduce you to their successor so you're not meeting them for the first time at your advisor's retirement party.

It's important to have clarity on what would happen to your financial affairs in such a situation. Typically, advisors have succession plans in place to ensure a smooth transition for their clients if they retire. This may involve passing on their client base to another advisor within the firm or arranging for a trusted colleague to take over their clients' accounts.

Red flag answer: "I'm not planning to retire anytime soon" (translation: I haven't thought about this).

Good answer: A detailed succession plan, ideally with an introduction to the advisor who would take over your account.

"What's your investment strategy and philosophy?"

If they say their strategy is the same for everyone, run.

Your investment approach should be as unique as your fingerprint. A 25-year-old software engineer saving for a house should have a completely different strategy than a 55-year-old business owner planning for retirement.

Also ask: "How do you make investment decisions?" Advisors at big firms often have research teams behind them. Independent advisors might rely on different resources. You should know what's driving your investment choices.

Red flag answer: One-size-fits-all approaches or inability to explain their decision-making process.

Good answer: Customized strategies based on your specific situation, with clear explanations of their research and decision-making process.

"What type of clients do you work best with?"

Great advisors know their sweet spot. Maybe they're amazing with tech workers who have complex stock options. Maybe they specialize in helping business owners navigate irregular income. Maybe they're the go-to person for young families juggling student loans and saving for kids.

If an advisor says they work with "everyone," that usually means they don't really specialize in anyone. You want someone who's seen your specific situation before and knows how to navigate it.

Red flag answer: "I work with all types of clients" without any specialization or relevant experience.

Good answer: Clear description of their ideal clients, with examples that sound like your situation.

"What non-investment advice do you provide?"

The best advisors aren't just portfolio managers – they're financial life coaches.

Maybe you need help deciding how much house you can afford. Maybe you're dealing with aging parents and need estate planning guidance. Maybe you're getting divorced and need someone to review settlement options.

A great advisor has seen these situations before and can either help directly or connect you with the right specialists.

Red flag answer: "I focus on investments" without broader financial planning support.

Good answer: Specific examples of how they've helped clients with complex life situations beyond just managing money.

Why These Questions Actually Work

Here's the thing about most advisor selection advice: it's written by people who've never actually hired an advisor.

These questions work because they cut through the marketing speak and reveal what working with this person will actually be like. They show you their experience, their priorities, and their blind spots.

More importantly, they put you in control of the conversation. Instead of being sold to, you're gathering the information you need to make a smart decision.

The Bottom Line

Look, choosing a financial advisor doesn't have to be this scary, overwhelming process that keeps you up at night.

But it also shouldn't be something you rush through just to check it off your to-do list. Your advisor will potentially be managing your money for decades. They should be someone who understands your situation, communicates in a way that works for you, and has a track record of actually helping people like you.

These 10 questions will tell you everything you need to know about whether someone deserves that responsibility.

The goal isn't to become a professional interviewer. It's to use your time wisely and find someone who can genuinely help you build the financial life you want.

Ready to start your search? Use AdvisorFinder's assessment to connect with financial advisors who fit your specific needs – then use these questions to find the 'right' one.

Frequently Asked Questions About Interviewing Financial Advisors

What if an advisor seems annoyed by my questions?

Run. Seriously. A good advisor welcomes questions because they want you to feel confident in your choice. If they're irritated by your due diligence, imagine how they'll handle your actual concerns about your money. You're not being difficult – you're being smart.

How many advisors should I interview before making a decision?

Most people find their match within three conversations. The first meeting teaches you what questions to ask. The second shows you what you don't want. By the third, you usually know if someone feels right. Don't overthink it – your gut reaction after asking these questions is valuable data.

Should I ask about their worst client experience or biggest mistake?

Absolutely. Ask: "Tell me about a time you had to deliver bad news to a client." Their answer reveals how they handle difficult conversations and whether they take responsibility for problems. Advisors who can't think of any challenging situations are either lying or haven't been around long enough.

What's a red flag answer to these questions?

Watch for vague responses, unwillingness to discuss fees clearly, or claims that "all my clients are successful." Also be wary if they can't explain their investment philosophy in plain English, or if they seem more interested in selling you products than understanding your situation.

How do I know if an advisor's communication style matches what I need?

Pay attention during your initial conversation. Do they explain things clearly without talking down to you? Do they ask follow-up questions about your goals? Most importantly: do you feel heard? If you're already feeling frustrated or confused in the interview, that won't improve once you're working together.

What if I can't afford their minimum investment requirement?

Ask directly about minimums upfront. Many advisors are flexible, especially for younger clients they expect to grow with. Some offer scaled-back services for smaller portfolios. If they're rigid about minimums without alternatives, they're not the right fit for where you are now.

Should I ask for references from current clients?

You can ask, but most advisors can't provide specific client references due to privacy regulations. Instead, ask them to describe their typical client relationship and what success looks like. Better yet, check if they have any client testimonials on their website or if they're willing to connect you with colleagues who can speak to their character.

What if I don't understand their investment strategy explanation?

Stop them and ask for a simpler explanation. A good advisor can explain their approach using everyday language. If they hide behind jargon or seem frustrated by your questions, that's a warning sign. Your money, your rules – you should understand exactly what they're doing with it.

How soon should I expect to hear back after our initial meeting?

Most advisors follow up within a few business days with next steps or additional information you discussed. If you don't hear anything for a week, that tells you something about their communication style and client priorities. Don't be afraid to reach out if you haven't heard back – their responsiveness now predicts their responsiveness later.

What if they want me to sign something during our first meeting?

Slow down. Legitimate advisors don't pressure you to commit immediately. Take any documents home to review, and don't let anyone rush your decision. High-pressure tactics are a major red flag in financial services. The right advisor wants you to feel completely comfortable before moving forward.